nys workers comp taxes

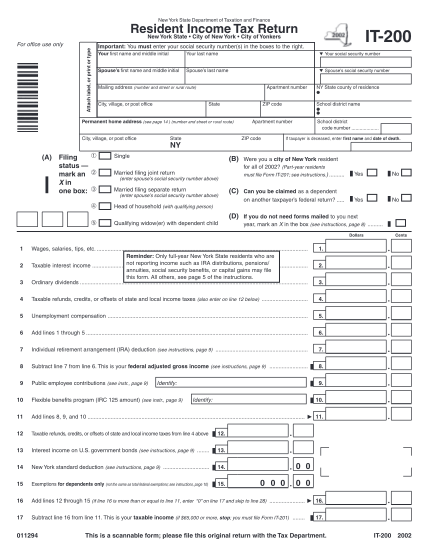

Get information about the benefits available under workers compensation including medical care lost wages and benefits for survivors. Payable to the New York State Department of Taxation and Finance within two and one half months of the close of the reporting period Tax Law Article 33.

If Board intervention is necessary it will determine whether that insurer will reimburse for cash benefits.

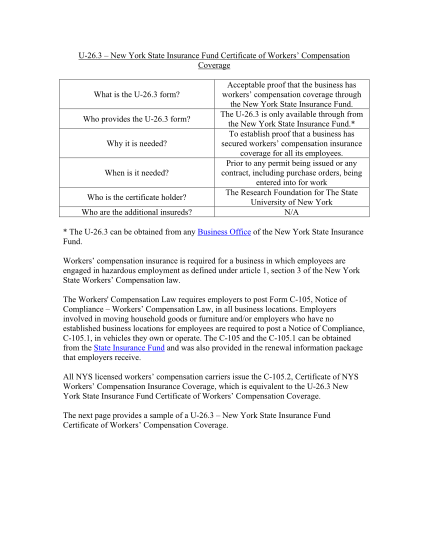

. Also under IRS regulations non-taxable workers. Registering as a new. A business must have an active NYSIF workers comp policy have more workers comp premium or payroll in New York State than in all other states combined and will be subject to NYSIF.

Employees in the Company NYS who have a Workers Compensation Board Award for a prior tax year and the Award is Credited to NYS. Information for Employers regarding Workers Compensation Coverage. In New York state law requires employers to cover all employees with workers compensation and disability insurance.

Workers compensation insurance is mandatory for most employers of one or more employees. When injured Worker A receives 1000 a month in SSDI benefits and another. Failure to comply with state workers compensation insurance rules can.

We have over 100 years of experience helping protect businesses with workers compensation insurance. New York State Insurance Fund- SIF. New York States Construction Industry Fair Play Act the Act took effect on October 26 2010.

Do you claim workers comp on taxes the answer is no. THAT offset amount is taxable. It protects employers from liability for on-the-job injury or illness and provides the following.

New York State Workers Compensation Board. If you hire household help such as a housekeeper babysitter or caretaker your responsibilities as a New York State employer may include. We can answer your.

Workers compensation benefits are not considered taxable income at the federal state and local levels. The amount of workers comp taken away is known as the workers compensation offset. Workers comp insurance and benefits can be tricky.

It increases to 3 in 2020 then to 5 in 2021. You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers compensation act or statute for an occupational injury or sickness. Worker As current earnings are 2000.

Workers compensation-related benefits are also exempt from New York State and local income taxes if applicable. Workers comp benefits are non-taxable insurance settlements. Provides services reported on a federal income tax Form 1099 if required by.

The Workers Compensation Board is a state agency that processes the claims. 20 Park Street Albany NY 12207 518-474-6670 NY Workers Compensation Board. Employers are required to withhold and pay personal income taxes on wages salaries bonuses commissions and other similar income paid to employees.

The Advocate for Business offers educational presentations on topics important to business such as an. Typically in New York workers that receive benefits from workers compensation due to an on the job injury are not subjected to taxes at the federal state or local levels.

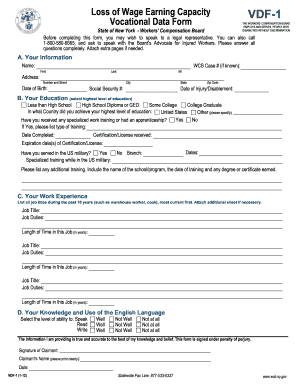

21 Printable Nys Workers Compensation Forms C 4 Templates Fillable Samples In Pdf Word To Download Pdffiller

Nys Workers Compensation Future Medical Settlements Paul Giannetti

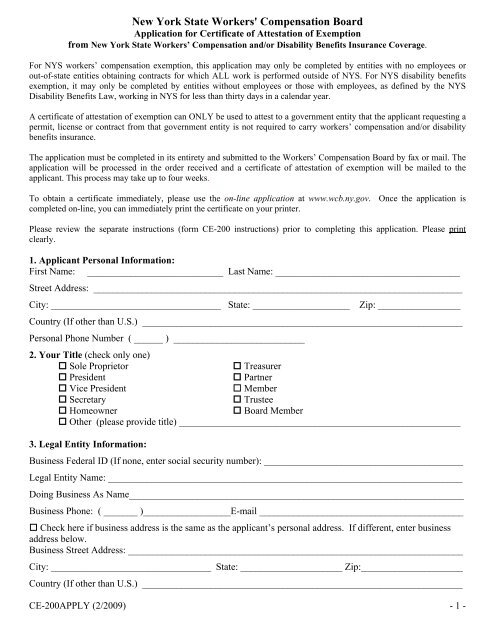

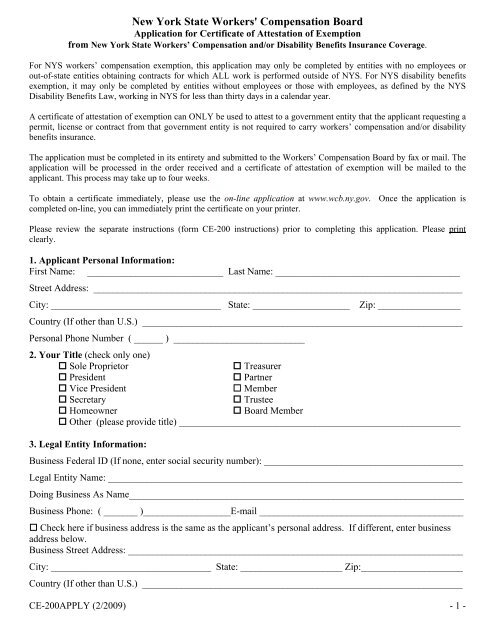

21 Nys Workers Compensation Exemption Form Free To Edit Download Print Cocodoc

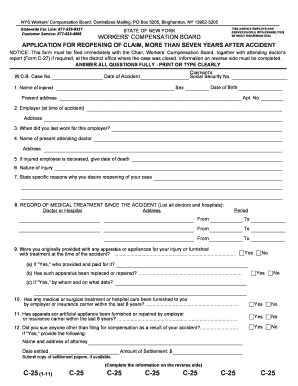

Fillable Online Wcb Ny State Of New York Workers Compensation Board Application For Reopening Of Claim More Than Seven Years After Accident Notice This Form Must Be Filed Immediately With The

Ce 200 Apply Workers Compensation Board New York State

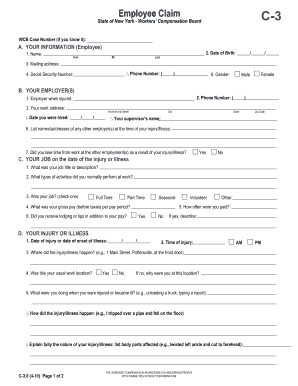

Ny Workers Compensation C 3 Form Injury Attorney

22 Printable Nys Workers Compensation Forms Templates Fillable Samples In Pdf Word To Download Pdffiller

22 Nys Workers Compensation Forms Free To Edit Download Print Cocodoc

The Ultimate Guide To Workers Compensation Laws In New York

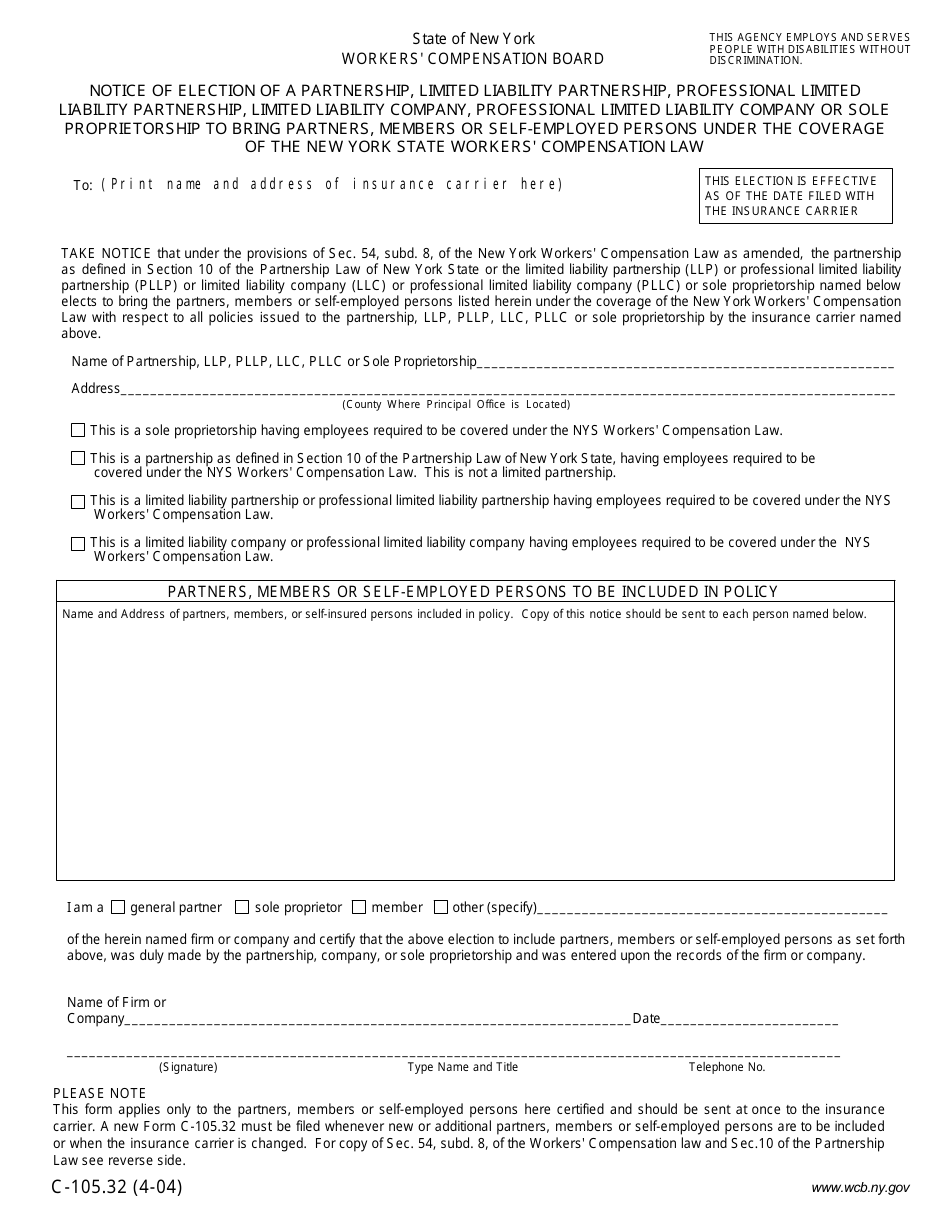

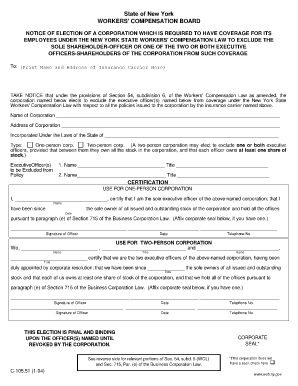

Form C 105 32 Download Fillable Pdf Or Fill Online Notice Of Election Of A Partnership Limited Liability Partnership Professional Limited Liability Partnership Limited Liability Company Professional Limited Liability Company Or Sole Proprietorship To

Ny Workers Comp Max Settlement Amounts Paul Giannetti Attorney At Law

Nys Workers Compensation Forms Fill Out And Sign Printable Pdf Template Signnow

21 Printable Nys Workers Compensation Forms C 4 Templates Fillable Samples In Pdf Word To Download Pdffiller

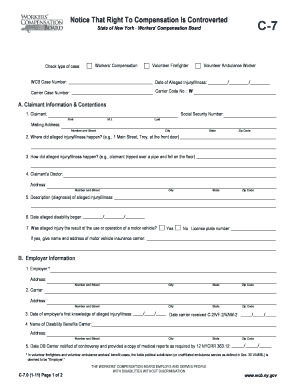

C7 Form Fill Online Printable Fillable Blank Pdffiller

New York Workers Compensation Claims Forms Friedlander Group Inc